Our experts

Citizenship by Investment

Assets Management

Trade Finance

The Journey

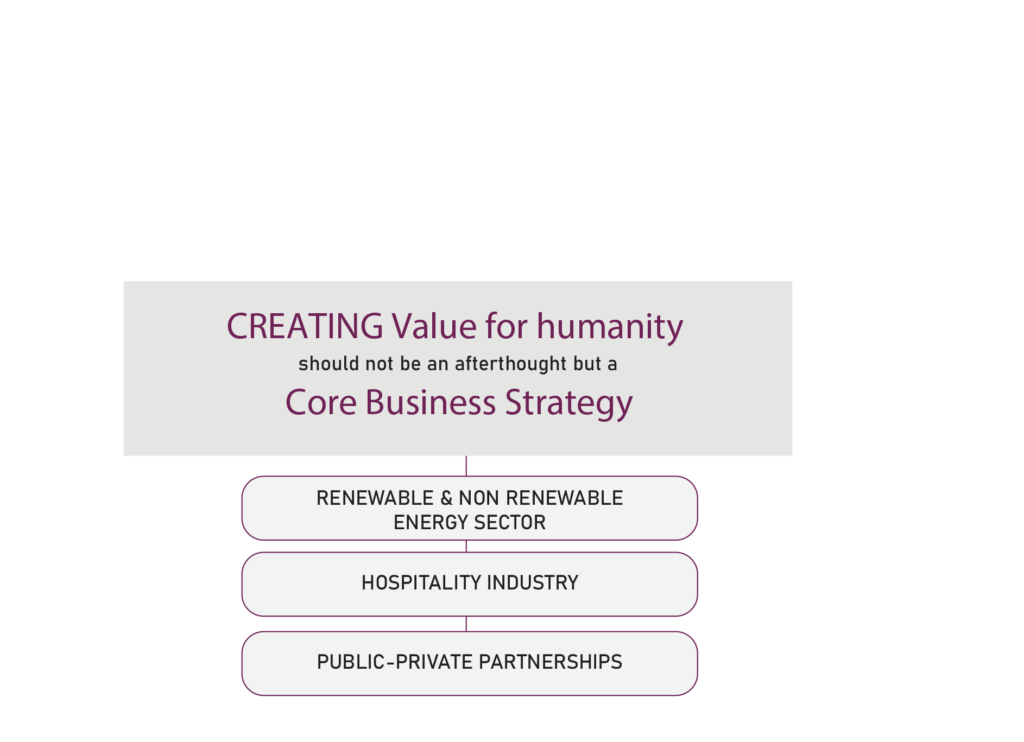

& The strategy

Organizing, synergizing and operating within the niche of enormous wealth potentials throughout the Asian Pacific Region, SECURO CAPITAL seize to capitalize investments incorporating cutting-edge ways to underpin efficiently effective process in ensuring the best investment returns with its partners.

Trade and invest in top stocks. Trade currency pairs 24/5, indices and commodities. Access to the financial market has never been easier. Buy and sell the shares of world’s biggest public companies with us. No Account Fees No Commissions No negative interest charges. Contact us today

Our

Investment Interest

Our Investment and financial areas of interest lies within these capital segments:

- Capital Market – Islamic Conventional

- Asset Management

- Aerospace Investments and Financing

- Financial Instruments & Monetization of Securities

- Trade Finance

- Project Finance

- Public-Private Partnership Programs

- Strategic Public Property Privatization Program Investment

- Advanced Technology Aerospace

- Robotic & I.T Investment

- Nanotechnology

- Hospitality

- Energy & Green Energy

- Food Manufacturing Industry

BEFORE ENTERING INTO AN ARRANGEMENT

the services the prospective proposes to provide and its capacity to deliver those services;

the adequacy of the infrastructure and systems available to deliver the services;

interest rate and fee structures comparison with interest and fee structures offered by other sources;

securities lending structure, such as the type of collateral required and the cost of such arrangements;

material provisions of documentation such as products trading, segregation of assets and events of default and their impact on the proposed trading activities of the investment fund;

familiarity and appropriate internal resources to service, the relevant investment strategy;

the amount of leverage prepared to provide to the fund and the basis on which this is provided;

the extent of segregation and ownership of assets and whether it is consistent with the particular legal requirements;

the credit worthiness including the legality applicable to any credit rating and the adequacy of its business continuity plans.

CULTURE AND PRINCIPLES